Location

Mount Vernon, WA 98274

Location

Mount Vernon, WA 98274

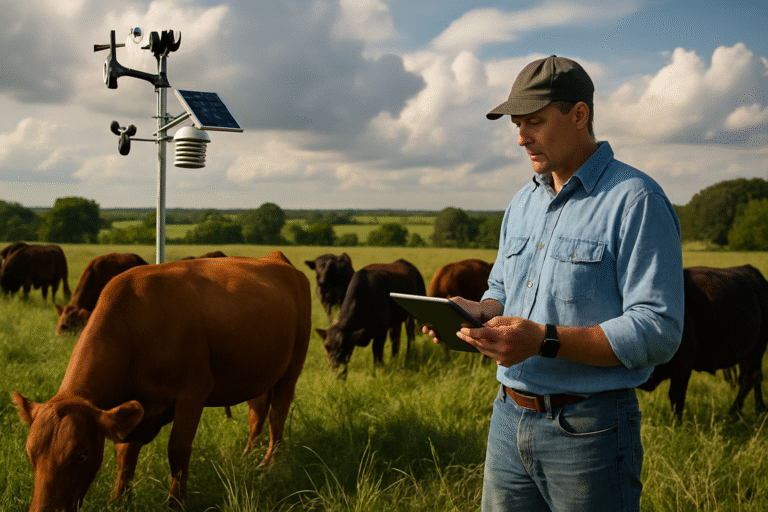

Faced with shifting weather patterns and tightening margins, livestock producers are turning to advanced monitoring tools, regenerative grazing models, and new revenue streams such as carbon credit programs. This article examines how farms are blending tradition and cutting-edge strategies to thrive in a rapidly changing agricultural landscape.

From ultra-precise atomic clocks to sprawling cosmic surveys, scientists are probing the deep interplay of time and matter. New data from gravitational wave observatories and dark matter mapping projects hint at a universe far stranger and more intricate than ever imagined.

An explosion of grassroots astronomy projects, open data initiatives and AI-driven analysis tools is turning everyday stargazers into genuine space explorers. Against a backdrop of rising light pollution and environmental concerns, a new community of curious minds is forging sustainable, privacy-respecting paths to unlock the universe's secrets.

From the crackle of volcanic lightning to the silent drift of ocean currents, the planet's forces constantly mold landscapes and human lives. Exploring the unexpected interplay between geology, atmosphere, and oceans reveals both new hazards and surprising opportunities for resilience.

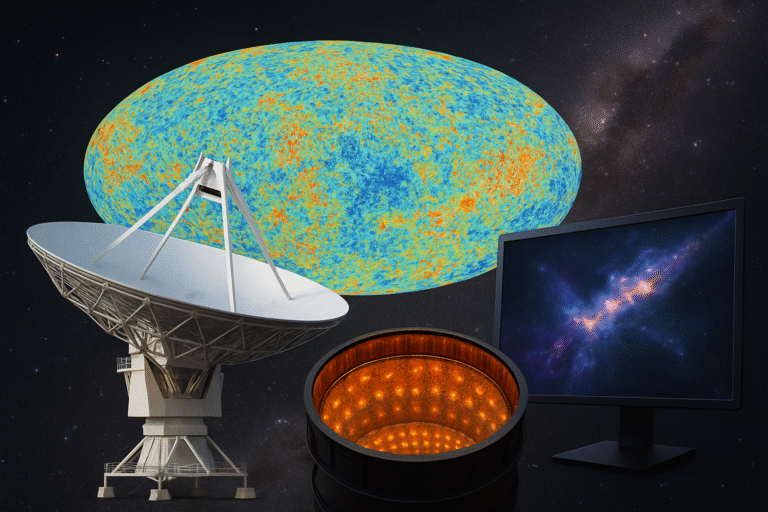

Recent advances in telescopes, detectors, and simulations are peeling back the veil on the universe's earliest moments. From faint echoes in the cosmic microwave background to ultra-sensitive neutrino detectors, scientists are piecing together a narrative of the cosmic dawn that enriches and challenges our understanding of existence.

Game audio is undergoing a quiet revolution as developers embrace procedural composition and adaptive mixing to craft immersive, personalized soundtracks. From meditation apps tapping generative engines to VR experiences that respond to biometric feedback, dynamic audio is reshaping entertainment, wellness and public art in sustainable, privacy-first ways.

As learning environments evolve, parents are weaving classroom lessons with homegrown projects, community collaborations, and mindful tech habits. This exploration reveals how families are reimagining education-nurturing adaptability, emotional intelligence, and hands-on discovery to prepare children for an unpredictable future.

Global sovereign debt markets are experiencing growing fragmentation as divergent monetary policies and shifting trade patterns reshape yields and credit risks. Emerging economies face new instruments from digital ledgers to green bonds, demanding novel strategies from investors. This article explores the forces redefining debt issuance across regions and how savers and markets may adapt.

A recent UNESCO pilot is transforming rural tourism by introducing co-living pods in five remote villages around the world. These modular accommodations blend local craftsmanship, mindful itineraries, and sustainable practices to offer travelers an authentic cultural deep dive.

From sensor-laden gadgets that monitor freshness to AI-driven recipe assistants that adapt to dietary needs, the modern kitchen is entering a new era of precision, sustainability, and personalization. Explore how recent innovations are reshaping the way home cooks interact with ingredients, appliances, and each other.